Ошибка авторизации «Do Not Honor» (то же самое, что и Отклонено — Не обслуживать) возникает при отправке платежа с помощью дебетовой или кредитной карты. Она означает, что Ваш банк не готов принять транзакцию.

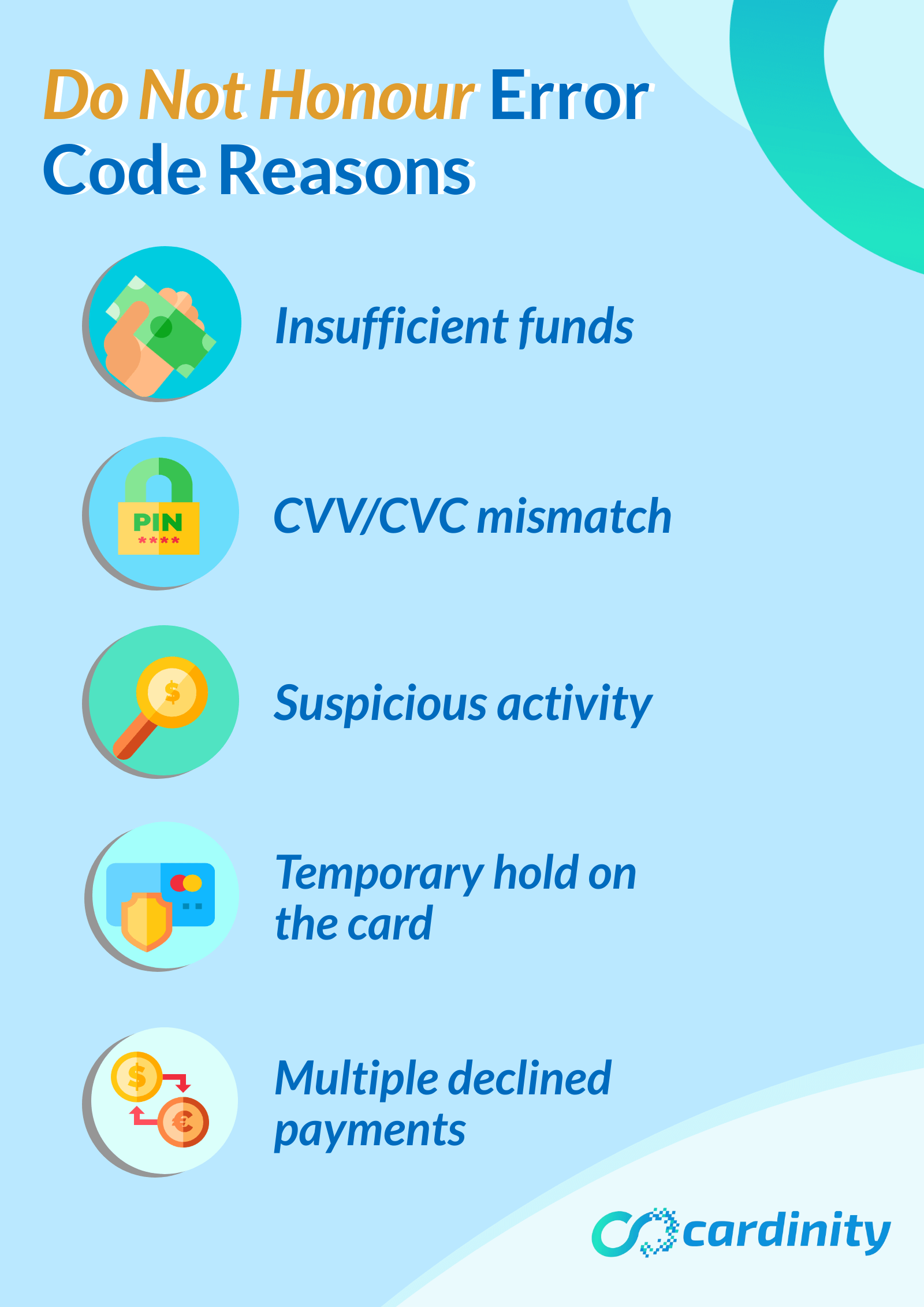

Самые распространённые причины данной ошибки:

Другая причина может заключаться в иностранной транзакции, что означает, что Вы пытаетесь совершить транзакцию в стране, отличной от страны, в которой выдана Ваша карта.

Точная причина может отличаться. Чтобы решить эту проблему быстрее, мы рекомендуем связаться с Вашим банком для получения более подробной информации. В качестве альтернативы Вы можете попробовать использовать другие способы оплаты, доступные в корзине.

“Do Not Honour” Payment Error Code: Reasons and Solutions

You have checked your transactions list and noticed that a big number of declined transactions are marked as Do Not Honour. What does it mean? It means that the cardholder’s issuing bank declined the payment for an unspecified reason. Such an explanation may still be vague and raise further questions. In this blog post, we will try to make things clearer.

First of all, it should be noted that all transaction decline statuses are sent by issuing banks. So, Cardinity does not determine the decline reasons in any way but only displays them in your account.

There can be various reasons why an issuing bank assigns Do Not Honour to certain transactions. Even though the bank does not provide explanations as to why a certain payment was declined with Do Not Honour, it is sometimes possible to find out the reason by looking at transaction details. Here are some of the logical explanations for Do Not Honour.

1. Insufficient funds

Even though there is a separate error code for insufficient funds, various issuing banks may mark a declined transaction as Do Not Honour instead of Not Sufficient Funds. If it is difficult for issuing banks to determine the correct response code, they use Do Not Honour as an all-inclusive reason. As Not Sufficient Funds is one of the most common reasons, it may be hiding under Do Not Honour.

2. CVV/CVC mismatch

Do Not Honour may also mean that a transaction was declined because of credential mismatch, e.g. CVV/CVC mismatch. The problem is that not all card networks and issuing banks have a special decline code for such mismatches. That is why the Do Not Honour response is used.

3. Suspicious activity

Card issuing banks have their own sets of factors which point to a cardholder’s suspicious or unusual behaviour. It does not necessarily indicate fraud; however, banks should prevent such transactions and protect cardholders’ funds. Some of the factors include the following ones: unusually large payment amount, transaction made at night, no additional authentication, multiple orders, or a previously made payment on a high-risk website. Usually, a transaction is declined when there is a combination of several factors. Unfortunately, as a seller, you do not receive any explanation from the bank but only the Do Not Honour response code.

4. Temporary hold on the card

For the same reasons as mentioned above, the card issuing bank may not only decline a payment but also put a hold on a customer’s card. If a customer tries to pay with a card which was put on hold, the issuing bank will respond with Do Not Honour.

5. Multiple declined payments

A customer may retry a payment if it has been declined once. After multiple declined payments in a row, the subsequent payment will be declined automatically with the response Do Not Honour. It means that the card has been temporarily locked, and the customer will not be able to make a payment without contacting the bank.

What to do in case of a Do Not Honour decline?

- First of all, you can ask your customer to use a different credit or debit card. If they don’t have another one, suggest alternative payment methods.

- You can also ask your customer to wait a few minutes or even hours and try again later. This solution does not always work for Do Not Honour declines because it may require assistance from the issuing bank.

- The customer can contact their bank and ask the bank to allow processing the payment on the merchant’s website.

- Moreover, ask the customer to check the card credentials to make sure that they entered everything correctly.

In order to avoid major issues with your customers, send notifications to inform them about declined payments and try to find a solution together. You can also add a coupon to the email as an apology for the occurred problems, so they would buy from you and not from your competitor. If you experience any problems or have any questions about payment error codes, feel free to contact us at Cardinity. You can also check the meanings of all response codes.

Open a merchant account for free

and start processing payments with Cardinity!

- Introduction

- What does a “do not honor” refusal code mean?

- Reasons for a “do not honor” code during a transaction

- How businesses can handle “do not honor” decline codes

Among the array of decline codes businesses encounter, the “do not honor” decline code is a common—yet somewhat mysterious—roadblock.

This decline code can leave both businesses and customers confused and frustrated. Learning how to decode this refusal and address it effectively is imperative for businesses that want to refine their operations, retain customers, and protect the integrity of their transactions.

We’ll cover what businesses need to know about “do not honor” card refusals, their potential causes, and effective strategies to handle them while minimizing disruptions.

What’s in this article?

- What does a “do not honor” refusal code mean?

- Reasons for a “do not honor” code during a transaction

- How businesses can handle “do not honor” decline codes

What does a “do not honor” refusal code mean?

“Do not honor” is a generic decline code that the issuing bank sends to the business during a transaction. It means that the bank is not willing to accept the transaction.

When processing a credit or debit card transaction, you may encounter a variety of refusal codes, each of which indicates a different problem or issue with the transaction. Unfortunately, the “do not honor” code doesn’t offer any specifics, so the cardholder will need to contact their bank to find out the exact reason for the decline. In many cases, the cardholder can resolve the issue quickly, and you can continue to process the transaction.

Reasons for a “do not honor” code during a transaction

When a bank chooses not to accept a transaction, it issues a “do not honor” decline code. The code itself doesn’t specify the reason for refusal, but depending on the situation there are many potential reasons:

-

Insufficient funds

This is a common reason for the “do not honor” code. For example, consider a customer who is trying to buy a designer jacket at a boutique. If their debit card is declined with a “do not honor” code, it might be because their checking account doesn’t contain the funds to cover the cost of the jacket. The same situation can happen online. If a customer tries to purchase a new gaming console from an ecommerce site but doesn’t have enough funds in their account, they would receive a “do not honor” code. -

Suspicious activity

Banks use advanced systems to monitor potential fraud. For example, imagine that a cardholder is traveling abroad and makes a purchase at a local market. The bank, unaware of the cardholder’s travel plans, may flag this as suspicious activity and decline the transaction, which results in a “do not honor” code. This can also happen online. If a customer—or a fraudulent actor—enters card details on a suspicious website, the bank may classify the transaction as a risk and decline it. -

Exceeding daily limit

Most cards have a daily limit on transactions. For instance, a business owner who is trying to purchase supplies at a wholesaler could receive a “do not honor” code if they’ve already made numerous high-cost purchases that day and the most recent transaction exceeds their card’s daily limit. Similarly, if a customer is paying multiple vendors for services on a freelancing platform and their total payments exceed the card’s daily limit, they would also receive a “do not honor” code. -

Incorrect card details

If the cardholder enters the card number, expiration date, or card verification code (CVV) number incorrectly, the transaction will be declined. For example, imagine a scenario at a restaurant where the server mistypes part of the card information into the system. The bank would decline the transaction, resulting in a “do not honor” code. This can also occur online if a customer enters their card details incorrectly while trying to make a purchase. -

Other account issues

Other account issues range from a closed account to a card that hasn’t been activated yet. If a customer tries to use a recently closed credit card account at a grocery store, for example, the transaction would be declined with a “do not honor” code. Similarly, if a customer tries to use a new card to make an online purchase before activating the card, they would receive the same decline code.

In all of these situations, the best course of action is for the customer to contact their bank to understand the exact reason behind the “do not honor” code and take necessary steps to resolve the issue.

How businesses can handle “do not honor” decline codes

When a business encounters a “do not honor” decline code during a transaction, they must have strategies in place to handle these situations effectively and minimize disruptions to the customer experience. Here are some ways businesses can respond:

-

Handling incorrect card information

If a decline arises from incorrect card details, such as an incorrect card number or expiration date, businesses should guide their customers to correct the error. In these cases, providing the customer with immediate feedback can be very useful. For instance, Stripe’s Checkout can notify the customer if the card they’re attempting to use has been declined, allowing them to correct any errors, try again, or use an alternative payment method. -

Managing suspected fraudulent activity

Card issuers may decline transactions if they suspect fraudulent activity, which can be challenging for businesses to handle. However, requiring customers to provide the CVV and postal code during checkout can significantly decrease the number of declines. Including additional information, such as the full billing address, can also improve decline rates, though this varies by card brand and country. If a business continues to experience a high number of declines, it could consider collecting this data. Additionally, implementing 3D Secure for payment authentication can help decrease decline rates in countries that support the service. -

Investigating “do not honor” declines

When it’s not clear what a particular “do not honor” decline refers to, analyzing accompanying data can help identify why the card may have been declined. For example, if CVV or address verification system (AVS) checks failed when the customer tried to add the card, resolving these issues and then re-attempting the charge may result in successful authorization. If a business notices that a card is issued in a different country from the one that corresponds to the client’s IP address, this may suggest a legitimate decline due to potential unauthorized card use.

In all of these scenarios, the key is to provide the customer with as much assistance as possible. By ensuring that the customer is informed about the situation and helping them navigate the necessary steps, you can maintain a positive customer experience, even in the face of a transaction decline.

-

Payment acceptance 101: Why it matters and how to improve acceptance rates

-

Card payments explained

-

What to know about Sofort payments

More articles

-

Payment acceptance 101: Why it matters and how to improve acceptance rates

-

Card payments explained

-

What to know about Sofort payments

More articles

-

Payment acceptance 101: Why it matters and how to improve acceptance rates

-

Card payments explained

-

What to know about Sofort payments

Access a complete payments platform with simple, pay-as-you-go pricing, or contact us to design a custom package specifically for your business.

76

51

076

9859

116

603

Insufficient funds

Not sufficient funds

Decline, not sufficient funds

— банк-эмитент удерживает дополнительные комиссии с держателя карты. Это может возникать в случаях погашение кредита посредством интернет-платежа, либо если договор на обслуживание банковской карты предусматривает дополнительные комиссии;

— происходит конвертация из валюты покупки в валюту карты. Убедитесь, что средств на карте достаточно для покрытия комиссии за конвертацию валют. Некоторые банки-эмитенты устанавливают комиссии на конвертацию валют как-правило в пределах 1%

50

5

9905

180

Transaction declined

Do not honor

Do not Honour

Transaction declined

Возможные причины:

— карта заблокирована или на ней установлен статус

— на карте не установлен лимит на оплату в интернет, либо этот лимит недостаточный

— сработали настройки системы безопасности банка-эмитента

— сработали ограничения по сумме или количеству операций по карте у банка-эмитента

— банк-эмитент установил ограничения на проведение данного типа транзакций

— по карте не разрешены международные платежи (доместиковая карта)

— банк-эмитент установил ограничение на транзакции с двойной конвертацией валют (DCC)

— банк-эмитент установил ограничения на транзакции в данной валюте

— банк-эмитент установил ограничения на транзакции в данной стране

— банк-эмитент в США ограничил по карте операции в валюте, отличной от USD

— банк-эмитент в США ограничил по карте операции в странах бывшего СНГ и других рисковых регионах

55

055

12

902

9882

9912

Invalid transaction

Invalid transaction card / issuer / acquirer

Decline reason message: invalid transaction

95

095

61

061

121

9861

9863

Decline, exceeds withdrawal amount limit

Exceeds amount limit

Exceeds withdrawal limit

Withdrawal limit would be exceeded

Withdrawal limit already reached

— на карте не установлен лимит операций в интернет или он уже достигнут или будет достигнут с текущей транзакцией

— общий лимит по сумме для операций покупок по карте уже достигнут или будет достигнут с текущей транзакцией

— карта не открыта для расчетов в интернет

— на карте не активирован сервис 3D-Secure из-за чего операции в интернет без 3D-Secure пароля попадают под ограничения банка-эмитента

65

065

82

082

9860

Activity count exceeded

Exceeds frequency limit

Maximum number of times used

— на карте не установлен лимит операций в интернет или он уже достигнут или будет достигнут с текущей транзакцией

— общий лимит по количеству операций покупок по карте уже достигнут или будет достигнут с текущей транзакцией

— карта не открыта для расчетов в интернет

— на карте не активирован сервис 3D-Secure из-за чего операции в интернет без 3D-Secure пароля попадают под ограничения банка-эмитента

57

119

Not permitted to client

Transaction not permitted on card

Transaction not permitted to card

Decline, transaction not permitted to cardholder

Transaction not permitted to card

Not permitted to client

Decline, transaction not permitted to cardholder

Function Not Permitted To Cardholder

Банк эмитент отклонил транзакцию так как она не может быть осуществлена для этой карты или клиента.

Возможные причины (более детально смотрите по банку-эквайеру выше):

— данный карточный продукт не рассчитан для такого типа операции

— для данной карты не настроен такой тип операции на стороне банка-эмитента

58

120

Decline, transaction not permitted to terminal

Not permitted to merchant

The requested service is not permitted for terminal

Function Not Permitted To Terminal

Txn Not Permitted On Term

211

N7

9881

Bad CVV2

Decline for CVV2 Failure

CVV2 is invalid

Invalid CVV2

Decline Cvv2 failure

CVV2 код также может называться CVC2, CID, CSC2 код.

В некоторых случаях такой код отказа может возвращаться и при вводе неверного срока действия карты.

Стоит обратить внимание, если банк эмитент использует динамический код CVV2, генерируемый на короткий промежуток времени в клиент-банке — срок жизни такого CVV2 кода мог истечь на момент совершения операции

058

59

059

62

062

9858

104

Restricted card

Restricted status

Decline, restricted card

Card is restricted

Your card is restricted

— операции по карте в данном регионе/стране не разрешены

— на карте установлен статус, ограничивающий платежи

— для карты не доступны интернет-платежи

56

056

Отказ может возникать в таких случаях:

— оплата картой локальной платежной системы за рубежом. Например картой платежной системы МИР за пределами РФ, картой платежной системы ПРОСТИР за пределами Украины

— оплата картами оплата AMERICAN EXPRESS, Diners Club,JCB, China Union Pay, Discover которые не поддерживаются платежным провайдером

— оплата картой Monobank в счет микро-кредитной организации (погашение кредита), либо выдача кредит. Монобанк блокирует операции в адрес МФО по некоторым типам карт

Монобанк, если карта этого банка

100

1000

Decline (general, no comments)

General decline, no comments

General decline

54

101

Expired card

Decline, expired card

Expired card

Pick-up, expired card

Card expired

— срок действия карты закончился

— указан неверный срок действия карты

— карта была перевыпущена с новым сроком

14

111

9852

1012

305113

Card number does not exist

Invalid card number

No such card

Decline, card not effective

Invalid card

Wrong card number

— неверный номер карты

— карта не действительна

— оплата картой локальной платежной системы за рубежом. Например картой платежной системы МИР за пределами РФ, картой платежной системы ПРОСТИР за пределами Украины

— оплата картами оплата AMERICAN EXPRESS, Diners Club,JCB, China Union Pay, Discover которые не поддерживаются платежным провайдером

— операции по карте в данном регионе/стране не разрешены

— на карте установлен статус, ограничивающий платежи

909

42

7

07

108

9875

207

42

External Decline Special Condition

Special Pickup

Pick up card (special)

Pick up card, special condition (fraud account)

Pick-up, special conditions

Decline, refer to card issuer’s special conditions

122

63

89

Decline, security violation

Security violation

— карточный счет заморожен или заблокирован

— ограничения правил безопасности (система Antifraud на стороне любого из участников)

Банк-эквайер (банк, обслуживающий торговую точку) или к платежному провайдеру

200

76

114

21

Invalid account

Decline, no account of type requested

No To Account

— счет карты закрыт или заблокирован

— по счету запрещены расходные операции

— карта не действительна

— неверный номер карты

— оплата картой локальной платежной системы за рубежом. Например картой платежной системы МИР за пределами РФ, картой платежной системы ПРОСТИР за пределами Украины

— оплата картами оплата AMERICAN EXPRESS, Diners Club,JCB, China Union Pay, Discover которые не поддерживаются платежным провайдером

— операции по карте в данном регионе/стране не разрешены

— на карте установлен статус, ограничивающий платежи

— карта не предназначена для расчетов в интернет

74

074

907

911

910

9872

91

291

82

908

810

Unable to authorize

Decline reason message: card issuer or switch inoperative

Destination not available

Issuer or switch inoperative

Issuer unavailable

Time-out at issuer

Decline reason message: card issuer timed out

Decline reason message: transaction destination cannot be found for routing

Transaction timeout

Ошибка связи: таймаут

Недоступен эмитент/эквайер

Таймаут при попытке связи с банком-эмитентом. Как правило такая ошибка возникает при проблемах технического характера на стороне любого из участников: банка-эквайера, банка эмитента, платежной системы Visa/MasterCard/МИР.

В первую очередь необходимо обратиться в банк-эквайер для выяснения причины и определения, на чьей стороне неисправности.

Банк-эквайер (банк, обслуживающий торговую точку) или к платежному провайдеру

Банк-эмитент (при получении 91 кода)

15

815

92

No such card/issuer

No such issuer

Invalid Issuer

811

96

0

4

04

44

43

200

104

Pick-up (general, no comments)

Pick up card

Your card is restricted

Hot Card, Pickup (if possible)

Hold — Pick up card

Pick-up, restricted card

Pick-up, card acceptor contact card acquirer

Также причиной может быть то, что карта только что выпущена и первой операцией для нее должна быть операция смены PIN-кода

205

110

13

567

9913

9867

Invalid advance amount

Decline, invalid amount

Invalid amount

— слишком маленькая сумма. Если карта открыта в валюте, убедитесь, что сумма транзакции не менее 1 цента доллара США или 1 Евро цента

— слишком большая сумма

— из суммы транзакции невозможно удержать сумму комиссии платежного провайдера. Убедитесь, что сумма транзакции не меньше суммы всех комиссий

— ограничения на карте плательщика на стороне банка, который выпуcтил карту.

— достигнуты лимиты на стороне банка-эквайера.

948

102

202

9934

59

Suspected fraud

Decline, suspected fraud

Также, возможно, что банк-эмитент заблокировал карту/счет в связи с подозрительными действиями, скиммингом, компрометацией

800

904

30

030

9874

574

Format error

Decline reason message: format error

41

540

208

9840

Lost Card, Pickup

Pick up card (lost card)

Lost card

Lost card, pick-up

Pick-up, lost card

93

124

Violation of law

Decline, violation of law

909

96

Decline reason message: system malfunction

System malfunction

01

02

107

108

Refer to card issuer

Decline, refer to card issuer

Decline, refer to card issuer special conditions

Refer to issuer

Также причиной может быть то, что карта только что выпущена и первой операцией для нее должна быть операция смены PIN-кода

43

209

057

9841

Pick up card (stolen card)

Pick-up, stolen card

Stolen card

Stolen card, pick-up

Lost/Stolen

Lost or stolen card

6000

106

Pre-authorizations are not allowed within this context.

Merchant is not allowed preauth

03

3

109

9903

20003

Invalid merchant

Decline, invalid merchant

Также причиной может быть некорректно переданный идентификатор мерчанта в транзакции