Some Background

REST APIs use the Status-Line part of an HTTP response message to inform clients of their request’s overarching result.

RFC 2616 defines the Status-Line syntax as shown below:

Status-Line = HTTP-Version SP Status-Code SP Reason-Phrase CRLF

A great amount of applications are using Restful APIs that are based on the HTTP protocol for connecting their clients. In all the calls, the server and the endpoint at the client both return a call status to the client which can be in the form of:

- The success of API call.

- Failure of API call.

In both the cases, it is necessary to let the client know so that they can proceed to the next step. In the case of a successful API call they can proceed to the next call or whatever their intent was in the first place but in the case of latter they will be forced to modify their call so that the failed call can be recovered.

RestCase

To enable the best user experience for your customer, it is necessary on the part of the developers to make excellent error messages that can help their client to know what they want to do with the information they get. An excellent error message is precise and lets the user know about the nature of the error so that they can figure their way out of it.

A good error message also allows the developers to get their way out of the failed call.

Next step is to know what error messages to integrate into your framework so that the clients on the end point and the developers at the server are constantly made aware of the situation which they are in. in order to do so, the rule of thumb is to keep the error messages to a minimum and only incorporate those error messages which are helpful.

HTTP defines over 40 standard status codes that can be used to convey the results of a client’s request. The status codes are divided into the five categories presented here:

- 1xx: Informational — Communicates transfer protocol-level information

- 2xx: Success -Indicates that the client’s request was accepted successfully.

- 3xx: Redirection — Indicates that the client must take some additional action in order to complete their request.

- 4xx: Client Error — This category of error status codes points the finger at clients.

- 5xx: Server Error — The server takes responsibility for these error status codes.

If you would ask me 5 years ago about HTTP Status codes I would guess that the talk is about web sites, status 404 meaning that some page was not found and etc. But today when someone asks me about HTTP Status codes, it is 99.9% refers to REST API web services development. I have lots of experience in both areas (Website development, REST API web services development) and it is sometimes hard to come to a conclusion about what and how use the errors in REST APIs.

There are some cases where this status code is always returned, even if there was an error that occurred. Some believe that returning status codes other than 200 is not good as the client did reach your REST API and got response.

Proper use of the status codes will help with your REST API management and REST API workflow management.

If for example the user asked for “account” and that account was not found there are 2 options to use for returning an error to the user:

-

Return 200 OK Status and in the body return a json containing explanation that the account was not found.

-

Return 404 not found status.

The first solution opens up a question whether the user should work a bit harder to parse the json received and to see whether that json contains error or not. -

There is also a third solution: Return 400 Error — Client Error. I will explain a bit later why this is my favorite solution.

It is understandable that for the user it is easier to check the status code of 404 without any parsing work to do.

I my opinion this solution is actually miss-use of the HTTP protocol

We did reach the REST API, we did got response from the REST API, what happens if the users misspells the URL of the REST API – he will get the 404 status but that is returned not by the REST API itself.

I think that these solutions should be interesting to explore and to see the benefits of one versus the other.

There is also one more solution that is basically my favorite – this one is a combination of the first two solutions, he is also gives better Restful API services automatic testing support because only several status codes are returned, I will try to explain about it.

Error handling Overview

Error responses should include a common HTTP status code, message for the developer, message for the end-user (when appropriate), internal error code (corresponding to some specific internally determined ID), links where developers can find more info. For example:

‘{ «status» : 400,

«developerMessage» : «Verbose, plain language description of the problem. Provide developers suggestions about how to solve their problems here»,

«userMessage» : «This is a message that can be passed along to end-users, if needed.»,

«errorCode» : «444444»,

«moreInfo» : «http://www.example.gov/developer/path/to/help/for/444444,

http://tests.org/node/444444»,

}’

How to think about errors in a pragmatic way with REST?

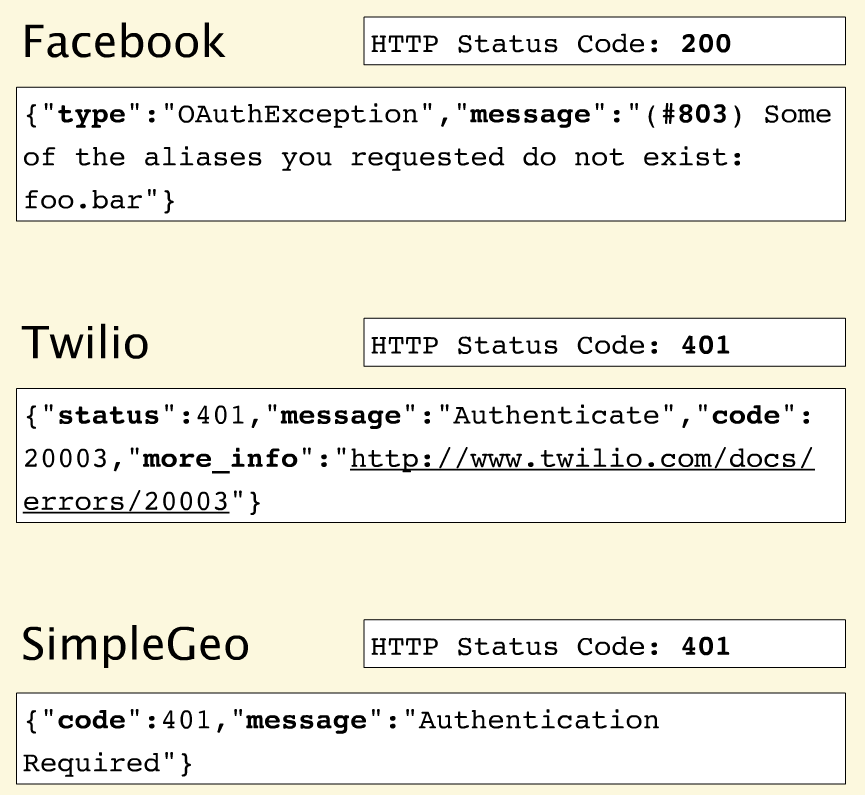

Apigee’s blog post that talks about this issue compares 3 top API providers.

No matter what happens on a Facebook request, you get back the 200 status code — everything is OK. Many error messages also push down into the HTTP response. Here they also throw an #803 error but with no information about what #803 is or how to react to it.

Twilio

Twilio does a great job aligning errors with HTTP status codes. Like Facebook, they provide a more granular error message but with a link that takes you to the documentation. Community commenting and discussion on the documentation helps to build a body of information and adds context for developers experiencing these errors.

SimpleGeo

Provides error codes but with no additional value in the payload.

Error Handling — Best Practises

First of all: Use HTTP status codes! but don’t overuse them.

Use HTTP status codes and try to map them cleanly to relevant standard-based codes.

There are over 70 HTTP status codes. However, most developers don’t have all 70 memorized. So if you choose status codes that are not very common you will force application developers away from building their apps and over to wikipedia to figure out what you’re trying to tell them.

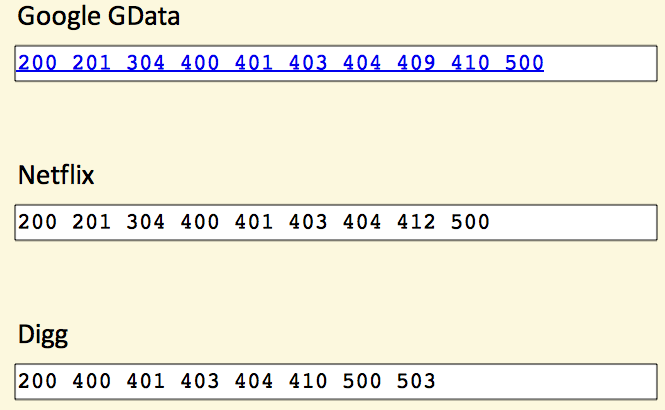

Therefore, most API providers use a small subset.

For example, the Google GData API uses only 10 status codes, Netflix uses 9, and Digg, only 8.

How many status codes should you use for your API?

When you boil it down, there are really only 3 outcomes in the interaction between an app and an API:

- Everything worked

- The application did something wrong

- The API did something wrong

Start by using the following 3 codes. If you need more, add them. But you shouldn’t go beyond 8.

- 200 — OK

- 400 — Bad Request

- 500 — Internal Server Error

Please keep in mind the following rules when using these status codes:

200 (OK) must not be used to communicate errors in the response body

Always make proper use of the HTTP response status codes as specified by the rules in this section. In particular, a REST API must not be compromised in an effort to accommodate less sophisticated HTTP clients.

400 (Bad Request) may be used to indicate nonspecific failure

400 is the generic client-side error status, used when no other 4xx error code is appropriate. For errors in the 4xx category, the response body may contain a document describing the client’s error (unless the request method was HEAD).

500 (Internal Server Error) should be used to indicate API malfunction 500 is the generic REST API error response.

Most web frameworks automatically respond with this response status code whenever they execute some request handler code that raises an exception. A 500 error is never the client’s fault and therefore it is reasonable for the client to retry the exact same request that triggered this response, and hope to get a different response.

If you’re not comfortable reducing all your error conditions to these 3, try adding some more but do not go beyond 8:

- 401 — Unauthorized

- 403 — Forbidden

- 404 — Not Found

Please keep in mind the following rules when using these status codes:

A 401 error response indicates that the client tried to operate on a protected resource without providing the proper authorization. It may have provided the wrong credentials or none at all.

403 (Forbidden) should be used to forbid access regardless of authorization state

A 403 error response indicates that the client’s request is formed correctly, but the REST API refuses to honor it. A 403 response is not a case of insufficient client credentials; that would be 401 (“Unauthorized”). REST APIs use 403 to enforce application-level permissions. For example, a client may be authorized to interact with some, but not all of a REST API’s resources. If the client attempts a resource interaction that is outside of its permitted scope, the REST API should respond with 403.

404 (Not Found) must be used when a client’s URI cannot be mapped to a resource

The 404 error status code indicates that the REST API can’t map the client’s URI to a resource.

RestCase

Conclusion

I believe that the best solution to handle errors in a REST API web services is the third option, in short:

Use three simple, common response codes indicating (1) success, (2) failure due to client-side problem, (3) failure due to server-side problem:

- 200 — OK

- 400 — Bad Request (Client Error) — A json with error \ more details should return to the client.

- 401 — Unauthorized

- 500 — Internal Server Error — A json with an error should return to the client only when there is no security risk by doing that.

I think that this solution can also ease the client to handle only these 4 status codes and when getting either 400 or 500 code he should take the response message and parse it in order to see what is the problem exactly and on the other hand the REST API service is simple enough.

The decision of choosing which error messages to incorporate and which to leave is based on sheer insight and intuition. For example: if an app and API only has three outcomes which are; everything worked, the application did not work properly and API did not respond properly then you are only concerned with three error codes. By putting in unnecessary codes, you will only distract the users and force them to consult Google, Wikipedia and other websites.

Most important thing in the case of an error code is that it should be descriptive and it should offer two outputs:

- A plain descriptive sentence explaining the situation in the most precise manner.

- An ‘if-then’ situation where the user knows what to do with the error message once it is returned in an API call.

The error message returned in the result of the API call should be very descriptive and verbal. A code is preferred by the client who is well versed in the programming and web language but in the case of most clients they find it hard to get the code.

As I stated before, 404 is a bit problematic status when talking about Restful APIs. Does this status means that the resource was not found? or that there is not mapping to the requested resource? Everyone can decide what to use and where

REST APIs use the Status-Line part of an HTTP response message to inform clients of their request’s overarching result. RFC 2616 defines the Status-Line syntax as shown below:

Status-Line = HTTP-Version SP Status-Code SP Reason-Phrase CRLF

HTTP defines these standard status codes that can be used to convey the results of a client’s request. The status codes are divided into five categories.

- 1xx: Informational – Communicates transfer protocol-level information.

- 2xx: Success – Indicates that the client’s request was accepted successfully.

- 3xx: Redirection – Indicates that the client must take some additional action in order to complete their request.

- 4xx: Client Error – This category of error status codes points the finger at clients.

- 5xx: Server Error – The server takes responsibility for these error status codes.

1xx Status Codes [Informational]

|

Status Code |

Description |

|---|---|

|

100 Continue |

An interim response. Indicates to the client that the initial part of the request has been received and has not yet been rejected by the server. The client SHOULD continue by sending the remainder of the request or, if the request has already been completed, ignore this response. The server MUST send a final response after the request has been completed. |

|

101 Switching Protocol |

Sent in response to an Upgrade request header from the client, and indicates the protocol the server is switching to. |

|

102 Processing (WebDAV) |

Indicates that the server has received and is processing the request, but no response is available yet. |

|

103 Early Hints |

Primarily intended to be used with the |

2xx Status Codes [Success]

|

Status Code |

Description |

|---|---|

|

200 OK |

Indicates that the request has succeeded. |

|

201 Created |

Indicates that the request has succeeded and a new resource has been created as a result. |

|

202 Accepted |

Indicates that the request has been received but not completed yet. It is typically used in log running requests and batch processing. |

|

203 Non-Authoritative Information |

Indicates that the returned metainformation in the entity-header is not the definitive set as available from the origin server, but is gathered from a local or a third-party copy. The set presented MAY be a subset or superset of the original version. |

|

204 No Content |

The server has fulfilled the request but does not need to return a response body. The server may return the updated meta information. |

|

205 Reset Content |

Indicates the client to reset the document which sent this request. |

|

206 Partial Content |

It is used when the |

|

207 Multi-Status (WebDAV) |

An indicator to a client that multiple operations happened, and that the status for each operation can be found in the body of the response. |

|

208 Already Reported (WebDAV) |

Allows a client to tell the server that the same resource (with the same binding) was mentioned earlier. It never appears as a true HTTP response code in the status line, and only appears in bodies. |

|

226 IM Used |

The server has fulfilled a GET request for the resource, and the response is a representation of the result of one or more instance-manipulations applied to the current instance. |

3xx Status Codes [Redirection]

|

Status Code |

Description |

|---|---|

|

300 Multiple Choices |

The request has more than one possible response. The user-agent or user should choose one of them. |

|

301 Moved Permanently |

The URL of the requested resource has been changed permanently. The new URL is given by the |

|

302 Found |

The URL of the requested resource has been changed temporarily. The new URL is given by the |

|

303 See Other |

The response can be found under a different URI and SHOULD be retrieved using a GET method on that resource. |

|

304 Not Modified |

Indicates the client that the response has not been modified, so the client can continue to use the same cached version of the response. |

|

305 Use Proxy (Deprecated) |

Indicates that a requested response must be accessed by a proxy. |

|

306 (Unused) |

It is a reserved status code and is not used anymore. |

|

307 Temporary Redirect |

Indicates the client to get the requested resource at another URI with same method that was used in the prior request. It is similar to |

|

308 Permanent Redirect (experimental) |

Indicates that the resource is now permanently located at another URI, specified by the |

4xx Status Codes (Client Error)

|

Status Code |

Description |

|---|---|

|

400 Bad Request |

The request could not be understood by the server due to incorrect syntax. The client SHOULD NOT repeat the request without modifications. |

|

401 Unauthorized |

Indicates that the request requires user authentication information. The client MAY repeat the request with a suitable Authorization header field |

|

402 Payment Required (Experimental) |

Reserved for future use. It is aimed for using in the digital payment systems. |

|

403 Forbidden |

Unauthorized request. The client does not have access rights to the content. Unlike 401, the client’s identity is known to the server. |

|

404 Not Found |

The server can not find the requested resource. |

|

405 Method Not Allowed |

The request HTTP method is known by the server but has been disabled and cannot be used for that resource. |

|

406 Not Acceptable |

The server doesn’t find any content that conforms to the criteria given by the user agent in the |

|

407 Proxy Authentication Required |

Indicates that the client must first authenticate itself with the proxy. |

|

408 Request Timeout |

Indicates that the server did not receive a complete request from the client within the server’s allotted timeout period. |

|

409 Conflict |

The request could not be completed due to a conflict with the current state of the resource. |

|

410 Gone |

The requested resource is no longer available at the server. |

|

411 Length Required |

The server refuses to accept the request without a defined Content- Length. The client MAY repeat the request if it adds a valid |

|

412 Precondition Failed |

The client has indicated preconditions in its headers which the server does not meet. |

|

413 Request Entity Too Large |

Request entity is larger than limits defined by server. |

|

414 Request-URI Too Long |

The URI requested by the client is longer than the server can interpret. |

|

415 Unsupported Media Type |

The media-type in |

|

416 Requested Range Not Satisfiable |

The range specified by the |

|

417 Expectation Failed |

The expectation indicated by the |

|

418 I’m a teapot (RFC 2324) |

It was defined as April’s lool joke and is not expected to be implemented by actual HTTP servers. (RFC 2324) |

|

420 Enhance Your Calm (Twitter) |

Returned by the Twitter Search and Trends API when the client is being rate limited. |

|

422 Unprocessable Entity (WebDAV) |

The server understands the content type and syntax of the request entity, but still server is unable to process the request for some reason. |

|

423 Locked (WebDAV) |

The resource that is being accessed is locked. |

|

424 Failed Dependency (WebDAV) |

The request failed due to failure of a previous request. |

|

425 Too Early (WebDAV) |

Indicates that the server is unwilling to risk processing a request that might be replayed. |

|

426 Upgrade Required |

The server refuses to perform the request. The server will process the request after the client upgrades to a different protocol. |

|

428 Precondition Required |

The origin server requires the request to be conditional. |

|

429 Too Many Requests |

The user has sent too many requests in a given amount of time (“rate limiting”). |

|

431 Request Header Fields Too Large |

The server is unwilling to process the request because its header fields are too large. |

|

444 No Response (Nginx) |

The Nginx server returns no information to the client and closes the connection. |

|

449 Retry With (Microsoft) |

The request should be retried after performing the appropriate action. |

|

450 Blocked by Windows Parental Controls (Microsoft) |

Windows Parental Controls are turned on and are blocking access to the given webpage. |

|

451 Unavailable For Legal Reasons |

The user-agent requested a resource that cannot legally be provided. |

|

499 Client Closed Request (Nginx) |

The connection is closed by the client while HTTP server is processing its request, making the server unable to send the HTTP header back. |

5xx Status Codes (Server Error)

|

Status Code |

Description |

|---|---|

|

500 Internal Server Error |

The server encountered an unexpected condition that prevented it from fulfilling the request. |

|

501 Not Implemented |

The HTTP method is not supported by the server and cannot be handled. |

|

502 Bad Gateway |

The server got an invalid response while working as a gateway to get the response needed to handle the request. |

|

503 Service Unavailable |

The server is not ready to handle the request. |

|

504 Gateway Timeout |

The server is acting as a gateway and cannot get a response in time for a request. |

|

505 HTTP Version Not Supported (Experimental) |

The HTTP version used in the request is not supported by the server. |

|

506 Variant Also Negotiates (Experimental) |

Indicates that the server has an internal configuration error: the chosen variant resource is configured to engage in transparent content negotiation itself, and is therefore not a proper endpoint in the negotiation process. |

|

507 Insufficient Storage (WebDAV) |

The method could not be performed on the resource because the server is unable to store the representation needed to successfully complete the request. |

|

508 Loop Detected (WebDAV) |

The server detected an infinite loop while processing the request. |

|

510 Not Extended |

Further extensions to the request are required for the server to fulfill it. |

|

511 Network Authentication Required |

Indicates that the client needs to authenticate to gain network access. |

6. REST Specific HTTP Status Codes

200 (OK)

It indicates that the REST API successfully carried out whatever action the client requested and that no more specific code in the 2xx series is appropriate.

Unlike the 204 status code, a 200 response should include a response body. The information returned with the response is dependent on the method used in the request, for example:

- GET an entity corresponding to the requested resource is sent in the response;

- HEAD the entity-header fields corresponding to the requested resource are sent in the response without any message-body;

- POST an entity describing or containing the result of the action;

- TRACE an entity containing the request message as received by the end server.

201 (Created)

A REST API responds with the 201 status code whenever a resource is created inside a collection. There may also be times when a new resource is created as a result of some controller action, in which case 201 would also be an appropriate response.

The newly created resource can be referenced by the URI(s) returned in the entity of the response, with the most specific URI for the resource given by a Location header field.

The origin server MUST create the resource before returning the 201 status code. If the action cannot be carried out immediately, the server SHOULD respond with a 202 (Accepted) response instead.

202 (Accepted)

A 202 response is typically used for actions that take a long while to process. It indicates that the request has been accepted for processing, but the processing has not been completed. The request might or might not be eventually acted upon, or even maybe disallowed when processing occurs.

Its purpose is to allow a server to accept a request for some other process (perhaps a batch-oriented process that is only run once per day) without requiring that the user agent’s connection to the server persist until the process is completed.

The entity returned with this response SHOULD include an indication of the request’s current status and either a pointer to a status monitor (job queue location) or some estimate of when the user can expect the request to be fulfilled.

204 (No Content)

The 204 status code is usually sent out in response to a PUT, POST, or DELETE request when the REST API declines to send back any status message or representation in the response message’s body.

An API may also send 204 in conjunction with a GET request to indicate that the requested resource exists, but has no state representation to include in the body.

If the client is a user agent, it SHOULD NOT change its document view from that which caused the request to be sent. This response is primarily intended to allow input for actions to take place without causing a change to the user agent’s active document view. However, any new or updated metainformation SHOULD be applied to the document currently in the user agent’s dynamic view.

The 204 response MUST NOT include a message-body and thus is always terminated by the first empty line after the header fields.

301 (Moved Permanently)

The 301 status code indicates that the REST API’s resource model has been significantly redesigned, and a new permanent URI has been assigned to the client’s requested resource. The REST API should specify the new URI in the response’s Location header, and all future requests should be directed to the given URI.

You will hardly use this response code in your API as you can always use the API versioning for the new API while retaining the old one.

302 (Found)

The HTTP response status code 302 Found is a common way of performing URL redirection. An HTTP response with this status code will additionally provide a URL in the Location header field. The user agent (e.g., a web browser) is invited by a response with this code to make a second. Otherwise identical, request to the new URL specified in the location field.

Many web browsers implemented this code in a manner that violated this standard, changing the request type of the new request to GET, regardless of the type employed in the original request (e.g., POST). RFC 1945 and RFC 2068 specify that the client is not allowed to change the method on the redirected request. The status codes 303 and 307 have been added for servers that wish to make unambiguously clear which kind of reaction is expected of the client.

303 (See Other)

A 303 response indicates that a controller resource has finished its work, but instead of sending a potentially unwanted response body, it sends the client the URI of a response resource. The response can be the URI of the temporary status message, or the URI to some already existing, more permanent, resource.

Generally speaking, the 303 status code allows a REST API to send a reference to a resource without forcing the client to download its state. Instead, the client may send a GET request to the value of the Location header.

The 303 response MUST NOT be cached, but the response to the second (redirected) request might be cacheable.

304 (Not Modified)

This status code is similar to 204 (“No Content”) in that the response body must be empty. The critical distinction is that 204 is used when there is nothing to send in the body, whereas 304 is used when the resource has not been modified since the version specified by the request headers If-Modified-Since or If-None-Match.

In such a case, there is no need to retransmit the resource since the client still has a previously-downloaded copy.

Using this saves bandwidth and reprocessing on both the server and client, as only the header data must be sent and received in comparison to the entirety of the page being re-processed by the server, then sent again using more bandwidth of the server and client.

307 (Temporary Redirect)

A 307 response indicates that the REST API is not going to process the client’s request. Instead, the client should resubmit the request to the URI specified by the response message’s Location header. However, future requests should still use the original URI.

A REST API can use this status code to assign a temporary URI to the client’s requested resource. For example, a 307 response can be used to shift a client request over to another host.

The temporary URI SHOULD be given by the Location field in the response. Unless the request method was HEAD, the entity of the response SHOULD contain a short hypertext note with a hyperlink to the new URI(s). If the 307 status code is received in response to a request other than GET or HEAD, the user agent MUST NOT automatically redirect the request unless it can be confirmed by the user, since this might change the conditions under which the request was issued.

400 (Bad Request)

400 is the generic client-side error status, used when no other 4xx error code is appropriate. Errors can be like malformed request syntax, invalid request message parameters, or deceptive request routing etc.

The client SHOULD NOT repeat the request without modifications.

401 (Unauthorized)

A 401 error response indicates that the client tried to operate on a protected resource without providing the proper authorization. It may have provided the wrong credentials or none at all. The response must include a WWW-Authenticate header field containing a challenge applicable to the requested resource.

The client MAY repeat the request with a suitable Authorization header field. If the request already included Authorization credentials, then the 401 response indicates that authorization has been refused for those credentials. If the 401 response contains the same challenge as the prior response, and the user agent has already attempted authentication at least once, then the user SHOULD be presented the entity that was given in the response, since that entity might include relevant diagnostic information.

403 (Forbidden)

A 403 error response indicates that the client’s request is formed correctly, but the REST API refuses to honor it, i.e., the user does not have the necessary permissions for the resource. A 403 response is not a case of insufficient client credentials; that would be 401 (“Unauthorized”).

Authentication will not help, and the request SHOULD NOT be repeated. Unlike a 401 Unauthorized response, authenticating will make no difference.

404 (Not Found)

The 404 error status code indicates that the REST API can’t map the client’s URI to a resource but may be available in the future. Subsequent requests by the client are permissible.

No indication is given of whether the condition is temporary or permanent. The 410 (Gone) status code SHOULD be used if the server knows, through some internally configurable mechanism, that an old resource is permanently unavailable and has no forwarding address. This status code is commonly used when the server does not wish to reveal exactly why the request has been refused, or when no other response is applicable.

405 (Method Not Allowed)

The API responds with a 405 error to indicate that the client tried to use an HTTP method that the resource does not allow. For instance, a read-only resource could support only GET and HEAD, while a controller resource might allow GET and POST, but not PUT or DELETE.

A 405 response must include the Allow header, which lists the HTTP methods that the resource supports. For example:

Allow: GET, POST

406 (Not Acceptable)

The 406 error response indicates that the API is not able to generate any of the client’s preferred media types, as indicated by the Accept request header. For example, a client request for data formatted as application/xml will receive a 406 response if the API is only willing to format data as application/json.

If the response could be unacceptable, a user agent SHOULD temporarily stop receipt of more data and query the user for a decision on further actions.

412 (Precondition Failed)

The 412 error response indicates that the client specified one or more preconditions in its request headers, effectively telling the REST API to carry out its request only if certain conditions were met. A 412 response indicates that those conditions were not met, so instead of carrying out the request, the API sends this status code.

415 (Unsupported Media Type)

The 415 error response indicates that the API is not able to process the client’s supplied media type, as indicated by the Content-Type request header. For example, a client request including data formatted as application/xml will receive a 415 response if the API is only willing to process data formatted as application/json.

For example, the client uploads an image as image/svg+xml, but the server requires that images use a different format.

500 (Internal Server Error)

500 is the generic REST API error response. Most web frameworks automatically respond with this response status code whenever they execute some request handler code that raises an exception.

A 500 error is never the client’s fault, and therefore, it is reasonable for the client to retry the same request that triggered this response and hope to get a different response.

The API response is the generic error message, given when an unexpected condition was encountered and no more specific message is suitable.

501 (Not Implemented)

The server either does not recognize the request method, or it cannot fulfill the request. Usually, this implies future availability (e.g., a new feature of a web-service API).

References :

https://www.iana.org/assignments/http-status-codes/http-status-codes.xhtml

Sponsor: Do you build complex software systems? See how NServiceBus makes it easier to design, build, and manage software systems that use message queues to achieve loose coupling. Get started for free.

How do you tell your API Consumers explicitly if there are errors or problems with their request? Everyone creating HTTP APIs seems to implement error responses differently. Wouldn’t it be great if HTTP API Errors had a standard? Well, there is! It’s called Problem Details (https://tools.ietf.org/html/rfc7807)

YouTube

Check out my YouTube channel where I post all kinds of content that accompanies my posts including this video showing everything that is in this post.

If you’re creating a RESTful HTTP API, Status Codes can be a good way to indicate to the client if a request was successful or not. The most common usage is 200 range status codes indicate a successful response and using 400 range indicate a client errors.

However, in most client error situations, how do you tell the client specifically what was wrong? Sure an HTTP 400 status code tells the client that there’s an issue, but what exactly is the issue?

Different Responses

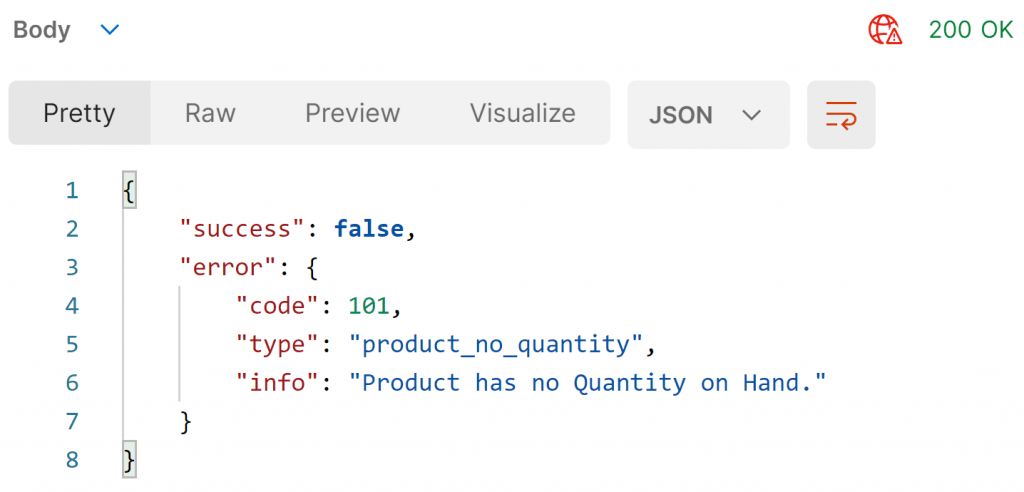

Here are two made-up examples that were inspired by 2 different APIs that I’ve recently consumed. Both indicate there a client error, however, they both do this in very different ways.

This first example is using a Status Code of 400 Bad Request, which is good. They provide a response body that has a Message member which is human readable. There is also a documentation member which is a URI, I assume to give the developer more info on why it occurred.

Here’s another example but very different response.

This response has an HTTP 200 OK. Which is interesting, to say the least. Instead, to indicate success or failure, they include in the response body a success member was a Boolean. There is an error object which is useful because it contains an info member, which is human readable. But what’s really nice is the code and type members which appear to be machine-readable. Meaning we can read their documentation, and write the appropriate code to handle when we receive an error with code=101, then we might want to show our end-user some specific message or possibly perform some other type of action.

Commonality

So what do these 2 different HTTP APIs have in common when it comes to providing the client with error information?

Nothing.

They are both providing widely different response body’s and using HTTP status codes completely differently.

This means that every time you’re consuming an HTTP API, you have to write 100% custom code to handle the various ways that errors are returned.

At the bare minimum, it would be nice if there was a consistent and standard way to define the human-readable error message. In one of the responses, this was called “message”, in the other, it was “error.info“.

Wouldn’t it be great if there was a standard for providing error info to your clients? There is! It’s called Problem Details (RFC7807)

HTTP [RFC7230] status codes are sometimes not sufficient to convey enough information about an error to be helpful. While humans behind Web browsers can be informed about the nature of the problem with an HTML [W3C.REC-html5-20141028] response body, non-human consumers of so-called "HTTP APIs" are usually not. This specification defines simple JSON [RFC7159] and XML [W3C.REC-xml-20081126] document formats to suit this purpose. They are designed to be reused by HTTP APIs, which can identify distinct "problem types" specific to their needs. Thus, API clients can be informed of both the high-level error class (using the status code) and the finer-grained details of the problem (using one of these formats).

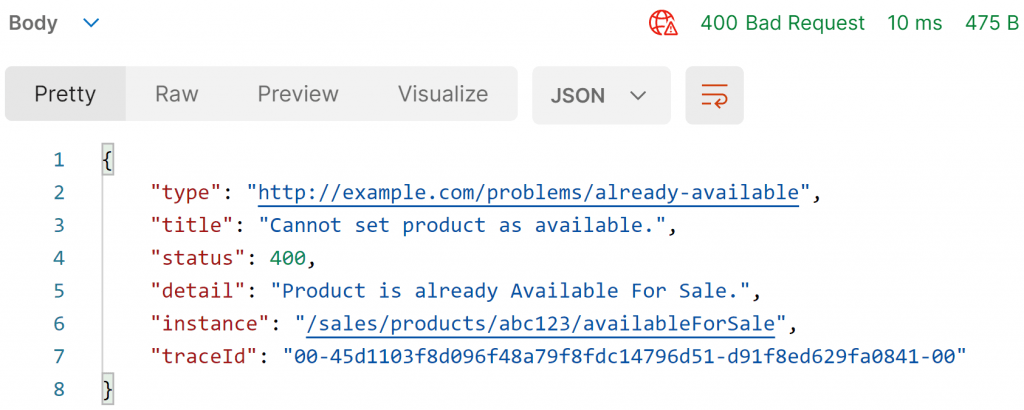

Here’s an example using Problem Details for the first example defined above.

“type“: URI or relative path that defines what the problem is. In a similar way, as the first example had a “documentation” member, this is the intent of this member as well. It’s to allow the developer to understand the exact meaning of this error. However, this is meant to also be machine-readable. Meaning this URI should be stable and always represent the same error. This way we can write our client code to handle this specific type of error how we see fit. It’s acting in a similar way as an error code or error key.

“title“: A short human-readable message of the problem type. It should NOT change from occurrence to occurrence.

“status“: The status member represents the same HTTP status code.

“detail“: Human-readable explanation of the exact issue that occurred. This can differ from occurrence to occurrence.

“instance“: A URI that represents the specific occurrence of the problem.

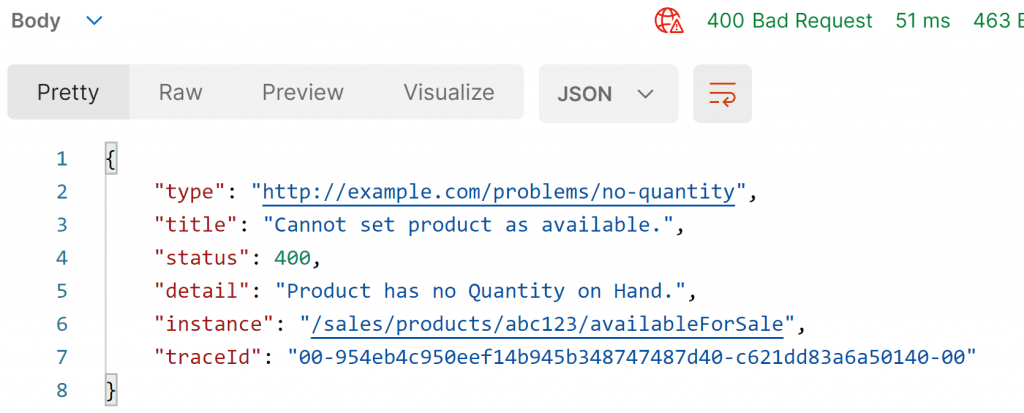

Here’s another example using Problem Details from the second example above.

Type & Extensions

In the example above, traceId is an extension. You can add any members you want to extend the response object. This allows you to provide more details to your clients when errors occur.

This is important because if you use the type member, which is the primary way you identify what the problem is, then you can provide more extension members based on the type you return.

In other words, in your HTTP API documentation, you can specify a problem type by its URI, and let the developer know there will be certain other extension members available to them for that specific problem.

Multiple Problems

As with everything, nothing is perfect. Problem Details has no explicit way of defining multiple problems in a single response. You can achieve this by defining a specific type, which indicates there will be a problems member which will be an array of the normal problem details members. Just as I described above to leverage bot the type and extensions together.

ASP.NET Core

If you’re using ASP.NET Core, you can use Problem Details today in your Controllers. Simply call the Problem() which returns an IActionResult.

If you don’t have thin controllers and have business logic outside of your controllers, then you can use Hellang.Middleware.ProblemDetails by Kristian Hellang which is a middleware that maps exceptions to problem details.

Source Code

Developer-level members of my CodeOpinion YouTube channel get access to the full source for any working demo application that I post on my blog or YouTube. Check out the membership for more info.

- Smarter Single Page Application with a REST API

- Decomposing CRUD to a Task Based UI

- Building a Self Descriptive HTTP API in ASP.NET Core

Follow @CodeOpinion on Twitter

001

Authentication failed

Authentication details are incorrect.

007

IP lockdown violation

You have locked down the API instance to a specific IP address but attempted to send from an IP address different to the one you have set.

100

Data malformed

The JSON/XML data submitted is invalid.

101

Invalid or missing parameters

One or more parameters are missing or invalid.

102

Invalid user data header

The format of the user data header is incorrect.

105

Invalid destination address

The destination address you are attempting to send to is invalid.

106

Invalid source address

The specified sender address is incorrect.

108

Invalid or missing API ID

The API ID is either incorrect or has not been included in the API call.

109

Missing message ID

This may refer to either a client message ID or API message ID – for example, when using the ‘stop message’ command.

113

Maximum message parts exceeded

The text component of the message is greater than the permitted 160 characters (70 Unicode characters). View the concatenation page for help in resolving this issue.

114

Cannot route message

This implies that the gateway is not currently routing messages to this network prefix. Please email support@clickatell.com with the mobile number in question.

116

Invalid unicode data

The format of the Unicode data entered is incorrect.

120

clientMessageId contains space(s)

Your specified client message ID contains a space. Space characters in client message IDs are not currently supported.

121

Destination mobile number blocked

This number is not allowed to receive messages from us and has been put on our blocked list.

122

Destination mobile opted out

The user has opted out and is no longer subscribed to your service.

123

Invalid Sender ID

The sender ID is not valid or has not been approved.

128

Number delisted

This number has been delisted and cannot receive our messages.

130

Maximum MT limit exceeded until <UNIX TIMESTAMP>

This error is returned when an account has exceeded the maximum number of MT messages that can be sent daily or monthly. You can send messages again on the date indicated by the UNIX TIMESTAMP.

160

HTTP method is not supported on this resource

An unsupported HTTP method has been performed on the resource. Example: HTTP POST on the Coverage resource.

161

Resource does not exist

You are attempting to access a REST API resource that does not exist.

165

Invalid or no version header specified

The expected header that specifies version was either not found or is invalid.

X-Version: 1166

Invalid accept header specified

The optional header that specifies acceptable content does not contain an allowed value.

167

Invalid or no content-type specified

The expected header that specifies content-type content was either not found or did not contain an allowed value.

250

Destination address is on DNC list – Do not contact receiver

DNC lookup for the destination address result shows that the receiver should not be contacted.

301

No credit left

Insufficient credits.

901

Internal error – please retry

An error occurred on our platforms.

Please retry submitting the message. This should be exceptionally rare.

These response codes provide a more detailed description of any problems which may have occurred with an API call including incorrect parameters or actions which violate the business logic of the system, such as illegal state changes, invalid amounts or dates, and so forth.

Please Note

The response codes listed below cover both Mambu API v1 and v2

Generic Response Codes (1 — 60)

| Response Code | Description |

|---|---|

0 SUCCESS |

The request was successful |

1 INVALID_BASIC_AUTHORIZATION |

The application ID or application key are not configured properly |

2 INVALID_CREDENTIALS |

The username and password provided was invalid |

3 INVALID_API_OPERATION |

The API URI is incorrect |

4 INVALID_PARAMETERS |

A required parameter for this API operation is invalid or has not been provided |

5 METHOD_NOT_IMPLEMENTED |

The HTTP method for this operation is not implemented. For example, the API operation has only been defined for HTTP GET request and an HTTP Post request was called |

6 INTERNAL_ERROR |

An unknown Mambu exception was thrown |

7 API_NOT_AUTHORIZED |

Caller is not authorized to make user of the API service. Check your Keys in the API Portal |

8 USER_TRANSACTION_LIMIT_EXCEEDED |

The API was not properly configured for monitoring |

9 API_CONFIGURATION_ERROR |

The API account is not authorized to make transactions (deposits, disbursals, etc) of this size |

10 INVALID_TENANT_ID |

No tenant to answer this API call was found |

11 INVALID_PAGINATION_OFFSET_VALUE |

The pagination offset value was not a proper Integer value |

12 OUT_OF_BOUNDS_PAGINATION_OFFSET_VALUE |

The pagination offset value was smaller than 0 |

13 INVALID_PAGINATION_LIMIT_VALUE |

The pagination limit value was not a proper Integer value |

14 OUT_OF_BOUNDS_PAGINATION_LIMIT_VALUE |

The pagination limit value was smaller than 0 or bigger than its upper limit |

15 INVALID_PERMISSIONS |

The user is missing permissions to complete an operation |

16 INVALID_IP_ADDRESS |

This IP address is not authorized for API access |

17 INACTIVE_USER |

User account is not active and cannot be used |

18 NO_API_ACCESS |

User doesn’t have API access permissions |

19 FEATURE_DISABLED |

|

20 MAX_FILE_SIZE_EXCEEDED |

The file size is larger than 5242880 bytes |

21 MAX_FILENAME_LENGTH_EXCEEDED |

The file name size, including the path, is larger than 256 characters |

22 UNSUPPORTED_CHARACTER_ENCODING |

The file has an unsupported character encoding. The character encoding must be supported by java |

23 INVALID_API_PROTOCOL |

The request was done through an invalid protocol. Mambu API’s always use HTTPS |

24 EXCESSIVE_INVALID_REQUESTS |

The account is temporarily disabled due to excessive incorrect logins and must be unlocked by an administrator. For instructions on how to re-enable the account, please see: Managing Users and Permissions |

25 INCONSISTENT_IDENTIFIER_WITH_JSON |

When the identifier does not match with the encoded key or ID from the JSON object |

26 INVALID_JSON_SYNTAX |

When the JSON parsing fails. Some cases that can cause this error: invalid JSON syntax, invalid enum values, invalid data type for value, etc |

27 PARAMETER_NOT_ALLOWED |

A parameter in the API call is not allowed in this context |

28 START_DATE_AFTER_END_DATE |

When the API parameter start date is after API parameter end date |

29 OBJECT_NOT_FOUND |

When no object is found for the given identifier |

30 MISSING_ENTITY_JSON |

When the required entity JSON object is missing |

31 MISSING_REQUIRED_PARAMETER |

A required parameter is missing from input |

33 UNSUPPORTED_PAGINATION |

|

34 NOT_AVAILABLE_FOR_API_V1 |

|

60 BLOCKING_OPERATION_IN_PROGRESS |

When operation cannot be performed due to another pending operation that locked shared resources |

61 QUERY_TIMEOUT_EXCEPTION |

Loan Accounts (97 — 199)

| Response Code | Description |

|---|---|

97 NON_REVERSIBLE_WRITE_OFF |

When the loan account cannot reverse the write-off transaction |

98 NON_WEEKLY_LOAN_REPAYMENTS |

When the entity, which is reassigned to a centre with a different centre meeting day, has a loan account with non-weekly repayments |

99 INCONSISTENT_LINKED_ACCOUNT |

When the linked account is not consistent with the current loan |

100 INVALID_LOAN_ACCOUNT_ID |

The loan account specified does not exist |

101 INVALID_AMOUNT |

The amount parameter is 0, not an integer, or otherwise invalid |

102 INVALID_DATE |

The date parameter is not properly formatted. Must follow the ISO standard such as: yyyy-MM-dd |

103 INVALID_NOTES |

The notes parameter is not valid |

104 INVALID_TRANSACTION_TYPE_ID |

When the provided ID or key for the transaction channel is invalid |

105 INVALID_ACCOUNT_STATE |

One of the accounts involved in the call is in an invalid state. This can occur for example when posting transactions to or from accounts in non-active statuses or when posting transactions that trigger bulk reversals to or from another account in non-active status |

106 INVALID_FEE |

The account is in an invalid state for the given operation |

107 LOAN_PRODUCT_MISMATCH |

The account parameters don’t match the loan product parameters |

108 INVALID_FIELD_FOR_TRANSACTION_TYPE |

When a field is given as a parameter, but the transaction type does not allow it |

109 INACTIVE_TRANSACTION_TYPE |

When trying to make a transaction using an inactive transaction channel |

110 EXCESS_REPAYMENT_ERROR |

The repayment amount exceed the loan balance |

111 TRANSACTION_LOGGED_AFTER_NOT_DISBURSED_TRANCHE |

When a transaction is logged after a non disbursed tranche |

112 UNDEFINED_ACCOUNT_FOR_FINANCIAL_RESOURCE_ERROR |

The account specified for the financial resource is not defined |

113 INVALID_ACCOUNT_FOR_JOURNAL_ENTRY_ERROR |

The account specified for the journal entry is invalid |

114 MISSING_LOAN_ID |

The loan account identifier has not been specified |

115 MAXIMUM_EXPOSURE_EXCEEDED |

when the maximum exposure is exceeded for a client |

116 INVALID_STATE_TRANSITION |

An invalid loan account state transition |

117 NUMBER_OF_LOANS_EXCEED |

When the number of loans for an organization is exceeded |

118 INVALID_FIRST_REPAYMENT_DUE_DATE |

When the first repayment due date it’s not valid |

119 INVALID_REPAYMENT_DUE_DAY |

When repayment date is not the same as assigned centre’s meeting day |

120 INVALID_INTEREST_RATE |

An invalid interest rate is being used as a parameter |

121 INVALID_INSTALLMENTS |

An invalid number of installments rate is being used as a parameter |

122 MISSING_LINKED_ACCOUNT |

|

123 PREPAYMENT_NOT_ALLOWED_ERROR |

When a pre-payment it’s trying to be posted and it’s not allowed at loan product level |

124 REPAYMENT_DATE_IN_THE_FUTURE_ERROR |

When the specified repayment date it’s set in future |

125 INVALID_DISBURSEMENT_DATE |

When the specified disbursement date is invalid |

126 INVALID_ACCOUNT_STATE_FOR_RESCHEDULE |

When the account’s state doesn’t allow a reschedule |

127 ORIGINAL_ACCOUNT_HAS_FUNDS |

When trying to reschedule a loan which has funds |

128 INVALID_ACCOUNT_STATE_FOR_REPAYMENTS |

When the account’s state doesn’t allow a repayment to be entered |

129 DISBURSEMENT_FEES_EXCEED_LOAN_AMOUNT |

When the total of disbursement fees exceeds the loan amount |

130 INTEREST_CANNOT_BE_APPLIED |

When the interest cannot be applied in the account, because either the account it’s not active, either there’s no interest to be applied, either it’s a flat fixed account and the interest has already been applied |

131 ENTRY_DATE_BEFORE_OTHER_TRANSACTIONS |

Another balance transaction has already been logged before this entry date and must be undone for this one to be backdated |

132 INCONSISTENT_SCHEDULE_PRINCIPAL_DUE_WITH_LOAN_AMOUNT |

When the total principal expected from the repayment schedule doesn’t match the loan amount (no rounding was selected) |

133 ACCOUNT_HAS_NO_ACCRUED_INTEREST |

When trying to apply the accrued interest and the account has no accrued interest |

134 INTEREST_ALREADY_APPLIED_ON_DISBURSEMENT_ACCOUNT |

When trying to apply interest for an account with Interest application method ‘On Disbursement’. In this case the interest was already applied |

135 INCONSISTENT_WITH_FIXED_DAYS_OF_MONTH |

When first repayment date doesn’t match the loan product Fixed days of month Payment interval method settings |

136 NEGATIVE_PRINCIPAL_FOR_INSTALLMENT |

When after the calculation of a repayments schedule, one of its repayments contains a negative principal |

137 INVALID_TAX_RATE |

When the tax rate for an account that has taxes enabled does not exist |

138 INSUFFICIENT_GUARANTEES |

When the loan account doesn’t have the required guaranties percentage |

139 MISSING_REPAYMENT_PERIOD_COUNT |

When the repayment period count is missing for a loan with a repayment method set to Interval |

140 MISSING_REPAYMENT_INTERVAL |

When the repayment interval is missing for a loan with repayment method set to Interval |

141 FUTURE_PAYMENT_NOT_ALLOWED_ERROR |

When a future payment is trying to be posted and it’s not allowed at loan product level |

142 DISBURSEMENT_WITH_ZERO_LOAN_AMOUNT_NOT_ALLOWED |

when a loan have zero loan amount and no cAPItalized fees, it can’t be disbursed |

143 ACCOUNT_ALREADY_LOCKED |

When trying to lock an account that is already in a LOCK state |

144 ACCOUNT_ALREADY_UNLOCKED |

When trying to unlock an account that is not in a LOCK state |

145 LOAN_AMOUNT_DECIMALS_NOT_ALLOWED_WITH_ROUNDING |

When trying to give an amount to a loan account that has rounding enabled |

146 RESCHEDULED_LOAN |

When the deletion is not allowed on the account, because it has been rescheduled |

147 REFINANCED_LOAN |

When the deletion is not allowed on the account, because it has been refinanced |

148 TRANSACTION_IDENTIFIER_ALREADY_USED |

When the posted transaction identifier has already been used; it already exists in the data store |

149 INVALID_ID |

When identifier for a posted transaction is only spaces or empty space |

150 FAILED_TO_GENERATE_IDENTIFIER |

When the account identifier failed to be generated due to internal concurrency issue |

151 INCONSISTENT_ACCOUNT_ID_WITH_ACCOUNT_HOLDER_TYPE |

when trying to fetch an account for a client using a group ID or vice-versa |

152 INVALID_ASSET_NAME |

When trying to store an account with guarantees of type asset and asset name is null |

153 GUARANTOR_KEY_NOT_ALLOWED |

When trying to store an account with guarantees of type asset, guarantor key should be empty |

154 GUARANTOR_SAVINGS_KEY_NOT_ALLOWED |

When trying to store an account with guarantees of type asset, deposit account key should be empty |

155 INVALID_GUARANTOR_KEY |

When trying to store an account with guarantees of type guarantor and guarantor key is empty |

156 INVALID_SAVINGS_ACCOUNT_KEY |

When trying to store an account with guarantees of type guarantor and deposit account key is empty |

157 INVALID_GUARANTOR_STATE |

When trying to store an account with guarantees of type guarantor and guarantor’s state is not ACTIVE or INACTIVE |

158 DUPLICATED_GUARANTOR_WITHOUT_SAVINGS_ACCOUNT |

When trying to store an account with guarantees the guarantor can guaranty only once without an account |

159 DUPLICATED_SAVINGS_ACCOUNT |

When trying to store an account with guarantees the guarantor cannot guaranty with the same account twice |

160 INSUFFICIENT_SAVINGS_ACCOUNT_BALANCE |

When the amount guaranteed in a given guaranty is not covered by the deposit account’s balance (if one existing) |

161 INVALID_SAVINGS_ACCOUNT_STATE |

When a deposit account used for a guarantee is not in ACTIVE, ACTIVE_IN_ARREARS, MATURED or LOCKED state |

162 DUPLICATED_ASSET |

When a guarantor guarantees twice with the same asset |

163 GUARANTOR_ASSET_NAME_NOT_ALLOWED |

When trying to store an account with guarantees of type guarantor, asset name should be empty |

164 TRANSACTION_NOT_FOUND |

When trying to undo the disbursement of a not found transaction |

165 INVALID_TRANSACTION_TYPE |

When trying to undo the disbursement of a transaction and its type is invalid |

166 UNREVERSED_TRANSACTION_LOGGED_AFTER_CURRENT_ONE |

When trying to post a transaction but there has already been a different transaction posted after it, which cannot be reversed by bulk correction |

167 INVALID_GUARANTOR_PERMISSION |

When trying to store a guarantee for a guarantor that does not have permissions to guarantee |

168 INVALID_CLIENT_ROLE_PERMISSION_FOR_OPENING_ACCOUNTS |

When trying to create a loan account for a client that does not have permissions for opening accounts. The permission can be granted from Client Type from administration |

169 MISSING_PENALTY_RATE |

When the product requires penalties but the account doesn’t have a penalty rate specified (or the product doesn’t have a default penalty rate) |

170 INVALID_REPAYMENT_NUMBER |

When the specified repayment number can’t be found in the schedule |

171 MISSING_REPAYMENT_NUMBER |

When the repayment number is mandatory but wasn’t specified |

172 INVALID_REPAYMENT_STATE |

When the state if the given repayment is not valid for the action |

173 CENTRE_MEETING_DAY_IN_NON_WORKING_DAY |

When a centre meeting day is set in a non-working day and the due date of the repayment has to be moved |

174 ARBITRARY_FEE_NOT_ALLOWED |

When an arbitrary fee is posted, but the product settings does not allow it |

175 INVALID_REPAYMENT_ID |

When the repayment posted does not belong to the account |

176 ACCOUNT_BALANCE_OUTSIDE_CONSTRAINTS |

When the account balance after applying the updates (principal balance, interest balance, etc) is negative or greater than the original balance |

177 EDITING_DATE_NOT_IN_CENTER_MEETING_DAY |

When editing a schedule for a loan account which has center meeting day, and the new edited value is not on the same day of week |

178 EDITING_DUE_DATES_NOT_ALLOWED |

When the product has interest application method ON_REPAYMENT and the repayment was fully paid or partially paid or the repayment had interest already applied, the due date of that repayment cannot be modified |

179 EDITING_REPAYMENTS_NOT_ALLOWED |

When the loan product does not allow editing the repayment schedule |

180 INTEREST_BALANCE_CANT_BE_EDITED_AT_SPECIFIED_DATE |

When the user can’t edit the interest from a specific repayment cannot be modified. For example when INTEREST DUE REDUCED is reversed and the user could reapply it on some other repayment |

181 INVALID_DUE_DATE |

When a due date of the schedule is not valid. For example: the due date of a repayment is before the due date of the previous repayment |

182 NEGATIVE_BALANCE |

When a balance (principal balance, interest balance, etc) for a repayment is negative |

183 NON_POSITIVE_TOTAL_BALANCE |

When the total balance for a repayment is not strictly positive |

184 PARAMS_INCONSISTENT_WITH_PRODUCT_RULES |

When the parameter from API call is inconsistent with product info (>max, <min, etc) |

185 INVALID_GRACE_PERIOD |

When grace period provided in API call is invalid (null, negative etc.) |

186 INVALID_ANTICIPATED_DISBURSEMENT |

When anticipated disbursement provided in API call is invalid (null, wrong date format etc.) |

187 INVALID_REPAYMENT_FREQUENCY |

When repayment period count or repayment period unit provided in API call is invalid (null, wrong value etc.) |

188 INVALID_PRINCIPAL_REPAYMENT_INVERVAL |

When principal repayment interval provided in API call is invalid (null, wrong value etc.) |

189 INVALID_PRODUCT_STATE |

When the product is in an invalid state for the given operation |

190 BALLOON_PAYMENTS_NOT_ALLOWED_BY_PRODUCT |

When a periodic payment amount is provided, but the product doesn’t allow balloon payments |

191 MANDATORY_PERIODIC_PAYMENT |

When a periodic payment amount is not provided, but the product offers balloon payments |

192 PERIODIC_PAYMENT_GREATER_THAN_LOAN_AMOUNT |

When the periodic payment amount is greater than the account’s whole loan amount |

193 MISSING_INTEREST_RATE_SPREAD_ON_PRODUCT |

When trying to preview a schedule for a loan product that has interest rate source equal to index interest rate and the product does not have a default interest spread defined |

194 FIRST_REPAYMENT_DATE_BEFORE_EXPECTED_DISBURSEMENT_DATE |

The first repayment cannot be before the expected disbursement date |

195 INVALID_PENALTY_RATE |

The penalty rate is not correct. The rate is either NULL when a number is expected, or not within the allowed product constraints |

196 CANNOT_EDIT_SOLIDARITY_LOANS |

The account belongs to a solidarity group and cannot be edited |

197 INVALID_INTEREST_SPREAD |

The interest spread is invalid (null, not within constraints or used when the interest rate source is FIXED_INTEREST_RATE) |

198 INVALID_PERIODIC_PAYMENT |

The periodic payment is not valid. The account does not use balloon payments |

199 UNKNOWN_LOAN_ACCOUNT_ERROR |

An error has occurred processing the loan account |

Groups (200 — 210)

| Response Code | Description |

|---|---|

200 MISSING_GROUP_ID |

The group identifier has not been specified |

201 INVALID_GROUP_ID |

No group with the given identifier exists |

202 INVALID_FULL_DETAILS |

The fullDetails parameter is not valid |

203 INVALID_INDICATORS |

The indicator specified is not valid |

204 GROUP_NOT_FOUND |

When no group is found for a given identifier |

205 INVALID_PARAMATERS_FOR_PRODUCT |

When the loan or deposit parameters are not valid for the given product |

206 INVALID_USER_WHO_APPROVED_THE_LOAN_CANNOT_DISBURSE_IT |

When the two man rule is enabled, the user who approved the loan cannot disburse it |

207 INVALID_GROUP_SIZE |

The group size is outside of organization’s constraints |

208 MULTIPLE_GROUP_MEMBERSHIP |

The group has clients that are already in the group and multiple membership is not allowed |

209 INVALID_GROUP_ROLE_NAME_KEY |

No group role name with the key provided |

210 GROUP_ROLE_CLIENT_NOT_GROUP_MEMBER |

The client ID provided for the role is not a group member |

Transactions and Till Balances (211 — 249)

| Response Code | Description |

|---|---|

211 TRANSACTION_ALREADY_REVERSED |

When trying to reverse a transaction which is already reversed |

212 INVALID_TRANSACTION_ID |

When trying to do an action on a transaction and the given ID is invalid |

213 TRANSACTION_ID_AND_ACCOUNT_MISMATCH |

When trying to do an action on a transaction for a given account and the transaction doesn’t belong to that account |

214 TRANSACTION_CREATED_DURING_IMPORT |

When trying to reverse a deposit transaction created during import. The imported transactions cannot be reversed |

215 TRANSACTION_LOGGED_FOR_CLOSED_TILL |

When a loan or deposit transaction was logged during the lifetime of a (now) closed till and an attempt is made to revert or delete the transaction |

216 TILL_BALANCE_ABOVE_MAX |

When the balance of the till goes above the defined maximum limit |

217 TILL_BALANCE_UNDER_MIN |

When the balance of the till goes under minimum limit |

218 TRANSACTION_MADE_FROM_A_TRANSFER |

When a deposit transaction is trying to be reversed, but it was made via transfer |

219 TRANSACTION_MADE_FROM_A_DISBURSEMENT |

When a deposit transaction is trying to be reversed, but it was made via a Disbursement transaction |

220 DEPOSIT_ACCOUNT_HAS_MATURITY_DATE_SET |

Deposit cannot be reverted for active fixed deposits accounts that have a maturity date set |

221 BALANCE_IS_NULL |

When a deposit transaction is trying to be reversed but the balance is null |

222 GUARANTOR_NOT_ALLOWED_BY_PRODUCT |

When trying to create a loan account with guarantor for a product that doesn’t allow guarantors |

223 COLLATERAL_NOT_ALLOWED_BY_PRODUCT |

When trying to create a loan account with collateral for a product that doesn’t allow collateral guarantees |

224 CANNOT_CHANGE_TILL_BALANCE |

When trying to change a till’s vault amount and the data is invalid |

225 DEDUCTED_FEES_TOTAL_MORE_THAN_LOAN_AMOUNT |

When trying to store a loan account and the total of deducted provided fees is more than the loan amount |

226 NO_CAPITALIZED_DISBURSEMENT_FESS_WHEN_ZERO_LOAN_AMOUNT |

When trying to store a loan account with loan amount zero and the developer does not provides any cAPItalized fee |

227 DISBURSE_TO_SAVINGS_NOT_AVALAIBLE_WITH_INVESTOR_FUNDS |

Disburse to deposit is not available when there are investor funds set on the account |

228 TRANSACTION_CHANNEL_IS_MANDATORY |

When trying to store a loan account with required transaction channel and the developer does not provides a transaction channel |

229 TRANSACTION_CHANNEL_NOT_AVAILABLE_WHEN_DISBURSE_TO_SAVINGS |

When trying to store a loan account and the developer provides a transaction channel and a deposit account key |

230 GUARANTOR_CANNOT_BE_DELETED |

When trying to delete a guarantor |

231 CUSTOM_AMOUNT_IS_MANDATORY |

When trying to store a loan account and the developer provides fees that require custom amount and the user does not specify it |

232 INVALID_TRANSACTION_CHANNEL |

When trying to store a loan account with required transaction channel and the developer provides an invalid transaction channel |

233 MISSING_FEE |

When trying to store a loan account and the developer provides custom fees that don’t have the predefined fee specified |

234 INCONSISTENT_ACCOUNT_FEE_WITH_PRODUCT_FEE |

When trying to store a loan account and the developer provides fees which are not defined in the loan product |

235 INCONSISTENT_DISBUSEMENT_DETAILS_WITH_ACCOUNT |

When trying to store a loan account and the developer provides the expected disbursement date or/and first repayment date twice (at account level and at disbursement details level) but different |

236 MISSING_TRANSACTION_CHANNEL_KEY |

When trying to store a loan account and the developer does not provides the transaction channel ID or encoded key |

237 TRANSACTION_DETAILS_NOT_AVAILABLE_FOR_PRODUCT |

When trying to store a loan account and the developer provides transaction details for a loan product type for which the transaction details are not available |

238 FEES_NOT_AVAILABLE_FOR_PRODUCT |

When trying to store a loan account and the developer provides predefined fees for a loan product type for which the predefined fees are not available to select for a loan account |

239 EXPECTED_DISBURSEMENT_DATE_NOT_AVAILABLE_FOR_PRODUCT |

When trying to store a loan account and the developer provides the expected disbursement date for a loan product type for which the expected disbursement date is not available to select for a loan account |

240 FIRST_REPAYMENT_DATE_NOT_AVAILABLE_FOR_PRODUCT |

When trying to store a loan account and the developer provides the first repayment date for a loan product type for which the first repayment date is not available to select for a loan account |

241 LOAN_PRODUCT_PREPAYMENT_OPTIONS_MISMATCH |

|

242 INVALID_LAST_REPAYMENT_DUE_DATE_CHANGE_BECAUSE_ACCOUNT_HAS_FULL_TERM_FEE_APPLIED |

|

243 INVALID_HOLIDAY_SETUP |

|

244 REDRAW_DISABLED |

When trying to make redraw operations on an account with redraw disabled |

245 INSUFFICIENT_REDRAW_BALANCE |

|

246 INVALID_FEES_DETAILS |

|

247 PRODUCT_DOES_NOT_ALLOW_WITHDRAWAL_TRANSACTIONS |

WITHDRAWAL_REDRAW transaction type is not allowed for given account product type |

| 248 `EXCESS_PAYMENT_MADE_AMOUNT | PAYMENT_MADE` |

249 PRODUCT_DOES_NOT_ALLOW_PAYMENT_MADE_TRANSACTIONS |

PAYMENT_MADE transaction type is not allowed for given account product type |

Disbursement with Fees (250 — 299)

| Response Code | Description |

|---|---|

250 MISSING_FEE_KEY |

When trying to disburse a loan account and the developer provides fees that don’t have an encoded key |

251 INVALID_FEE_KEY |

When trying to disburse a loan account with given fees but the fee encoded key is not valid or it’s not available for the loan account product |

252 INCONSISTENT_FEE_AMOUNT_WITH_PRODUCT_FEE |

When trying to disburse a loan account with given fees and the developer provides at |

253 FEE_AMOUNT_MUST_BE_STRICTLY_POSITIVE |

When trying to disburse a loan account with given fees and the provided amount is not strictly positive |

254 REQUIRED_FEE_MISSING |

When trying to disburse a loan account with given fees and the developer does not provide all required fees defined in the loan product |

255 FEE_NOT_ACTIVE |

When trying to disburse a loan account with given fees and the developer provides fees that are inactive |

256 FEE_NOT_ALLOWED |

When trying to disburse a loan account and the developer provides a fee that is not a disbursement fee, or when trying to edit fee due on schedule but the schedule does not allow it |

257 INCONSISTENT_FIRST_REPAYMENT_DATE_WITH_PRODUCT_OFFSET |

When trying to compute the schedule but the first repayment date is not between defined offset in the loan product |

258 MISSING_ORIGINAL_TRANSACTION_ID |

When trying to reverse a transaction but the original transaction ID is not present in the API call parameters/JSON |

260 REPAYMENT_WAS_FULLY_PAID |

When attempting to edit the due date for a repayment that was already fully paid |

261 REPAYMENT_HAS_INTEREST_APPLIED |

Interest applied transactions are logged after the repayment date. You will need to revert them before entering the repayment, so that the interest is calculated based on the new amounts |

262 DUE_DATE_BEFORE_ACCOUNTING_CLOSURE |

When editing a repayment due date and there is a GL accounting closure after the due date |

263 DUE_DATE_BEFORE_LOGGED_TRANSACTION |

When editing a repayment due date and the account has a transaction logged after the due date |

264 INVALID_PARENT_ACCOUNT_KEY |

When the parent account key provided for a custom-made repayment is not the same as the one for the actual account |

265 AUTOMATICALLY_ADDED_INSTALLEMENTS_ARE_NOT_EDITABLE |

For fixed accounts using the «apply interest after maturity» option, a new installment is added when interest is applied after the maturity date. This installment is not editable |

266 PURE_GRACE_INSTALLMENT_ARE_NOT_EDITABLE |

Pure grace installments are not editable |

267 CUSTOM_PAYMENT_NOT_ALLOWED_BY_PRODUCT |

When a custom payment repayment is made, but the product settings do not allow this |

268 SAME_CUSTOM_PAYMENT_AMOUNT_TYPE_USED_MULTIPLE_TIMES |

When a custom payment amount type is used more than once |

269 CUSTOM_PAYMENT_AMOUNT_DIFFERENT_THAN_TOTAL_PAYMENT_AMOUNT |

When a custom payment repayment is made and the sum of the custom payment amounts is different than the repayment total amount |

271 ARREARS_TOLERANCE_PERIOD_OUTSIDE_CONSTRAINTS |

When storing arrears tolerance period for loan account that is outside loan product constraints |

272 NEGATIVE_ARREARS_TOLERANCE_PERIOD |

When storing an arrears tolerance period for loan account that is a negative number |

273 REQUIRED_ARREARS_TOLERANCE_PERIOD_MISSING |

When storing an arrears tolerance period for loan account and the loan product doesn’t have a default tolerance period defined |

274 DUE_DATE_BEFORE_FEE_AMORTIZATION |

When editing a repayment due date and there is a fee amortization after the due date |

275 MAX_CLIENT_LIMIT_REACHED |

When the maximum number of clients has been reached for a tenant |

276 PENALTY_METHOD_NOT_ALLOWED_BY_PRODUCT |

When the penalty method is not allowed by product settings |

277 CANNOT_REVERSE_TECHNICAL_OVERDRAFT |

When a transaction cannot be reversed due to existing technical overdraft |

278 INSUFFICIENT_BALANCE |

When transactions cannot be reversed because the ending available balance would become negative |

279 INVALID_PRODUCT_TYPE |

When using a loan type other than revolving credit. Returns the error message: "errorSource": "Operation is not allowed for the product type: {*product_loan_type*}« |

280 DUPLICATE_DISBURSEMENT_FEE |

|

282 NO_DUE_AMOUNT_TO_BE_PAID |

Redraw repayment is not available when the account has no due amount to be paid |

299 UNKNOWN_GROUP_ERROR |

An error has occurred processing the group |

Clients (300-399)

| Response Code | Description |

|---|---|

300 MISSING_CLIENT_ID |

The client identifier has not been specified |

301 INVALID_CLIENT_ID |

The client identifier is invalid |

302 INVALID_CLIENT_KEY |

|

303 INVALID_PICTURE_KEY |

When the key of the picture is not valid |

304 INVALID_SIGNATURE_KEY |

When the key of the signature is not valid |

305 INVALID_CLIENT_STATE |

When the client/group state does not allow to be a guarantor or have a loan/deposit account |

306 INVALID_CLIENT_ROLE_KEY |

When trying to store a client and the role key is invalid |

307 INCONSISTENT_CLIENT_ROLE_WITH_CLIENT_TYPE |

When trying to store a client role of type GROUP for a client |

308 INVALID_DEPENDENT_CUSTOM_FIELD_VALUE |

When trying to store dependent custom field values with inconsistency with their parent custom field value |

309 INVALID_BIRTH_DATE |

When birth date is required by internal controls but the value was missing from input |

310 DUPLICATE_CLIENT |

When a duplicate client is found |

311 INVALID_CLIENT_STATE_TYPE |

When attaching a client and the state provided is invalid |

312 INVALID_CLIENT_STATE_TRANSITION |

When trying to change the state of a client but the change cannot be done |

313 CLIENT_IS_MEMBER_OF_A_GROUP |

When trying to reject or undo approve a client which is part of a group |

314 CLIENT_IS_GUARANTOR |

When trying to change the state of a client which is guarantor and the action is not permitted |

315 CLIENT_HAS_ACCOUNTS |

When trying to exit a client which has accounts which aren’t closed |

316 CLIENT_ID_ALREADY_IN_USE |

|

317 GROUP_ID_ALREADY_IN_USE |

|

318 GROUP_HAS_ACCOUNTS |

|

319 MISSING_CLIENT_BASIC_DETAILS |

|

320 EMAIL_ADDRESS_SIZE_INVALID |

|

399 UNKNOWN_CLIENT_ERROR |

An error has occurred processing the client |

Loan/Deposit accounts (400 — 599)

| Response Code | Description |

|---|---|

400 INVALID_SAVINGS_ACCOUNT_ID |

No deposit account with the given identifier exists |

401 BALANCE_BELOW_ZERO |

The API operation would result in a balance below zero |

402 MISSING_SAVINGS_ID |

The specified deposit account is not valid |

403 BACKDATE_BEFORE_ACTIVATION |

Operations shouldn’t be backdated before the activation date of a deposit account |

404 BACKDATE_BEFORE_OTHER_OPERATION |

Operations shouldn’t be backdated before other existing date |

405 BACKDATE_SET_IN_THE_FUTURE |

When the operation is backdated in the future |

406 INVALID_DEPOSIT_AMOUNT |

When the amount value is not between minimum opening balance and maximum opening balance values |

407 INVALID_DEPOSIT_ACCOUNT_STATE |

When the deposit does not have the valid state for this operation (Active or Approved) |

408 LOCKED_SAVINGS_AMOUNT |

When the deposit amount cannot be decreased below the locked amount by withdraw or transfer |

409 SAVINGS_PRODUCT_MISMATCH |

When the deposit account has parameters different to those defined in the deposit product |

410 SAVINGS_ACCOUNT_INVALID |

When the accountType is missing while creating a new deposit account |

411 ACCOUNT_ID_ALREADY_IN_USE |

The account ID must be unique. |

412 PRODUCT_DOESNT_ALLOW_WITHHOLDING_TAXES |

The product does not support withholding taxes |

413 INVALID_WITHHOLDING_TAX_SOURCE_TYPE |

The key is a valid index rate encoded key but not a withholding tax source key |

414 INVALID_INTEREST_CHARGE_FREQUENCY |

When the received deposit account has an Interest Charge Frequency Method different than the product’s |

415 INVALID_INTEREST_CHARGE_FREQUENCY_COUNT |

When the received deposit account has an Interest Charge Frequency Count different than the product’s, or the Interest Charge Frequency Method doesn’t support this field |

416 INVALID_SAVINGS_ACCOUNT_STATE_TRANSITION |

When the deposit account state does not allow the account state transition |

417 MAXIMUM_WITHDRAWAL_AMOUNT_EXCEEDED |